By Matilde Bates April 13, 2025

When the customer swipes their credit card at your store, it triggers an intricate dance of transactions in the background. Embedded within this process is a key but often confused element: interchange rates. These rates determine the economics of payment processing and directly affect your bottom line.

Interchange is the biggest cost merchants incur for accepting card payments. Despite its importance, few business owners have any idea how interchange works or understand it to be just one of those unavoidable business costs. Knowing how these rates operate can enable you to make better decisions on your payment strategy and, as a bonus, save huge amounts of money.

What are Interchange Rates?

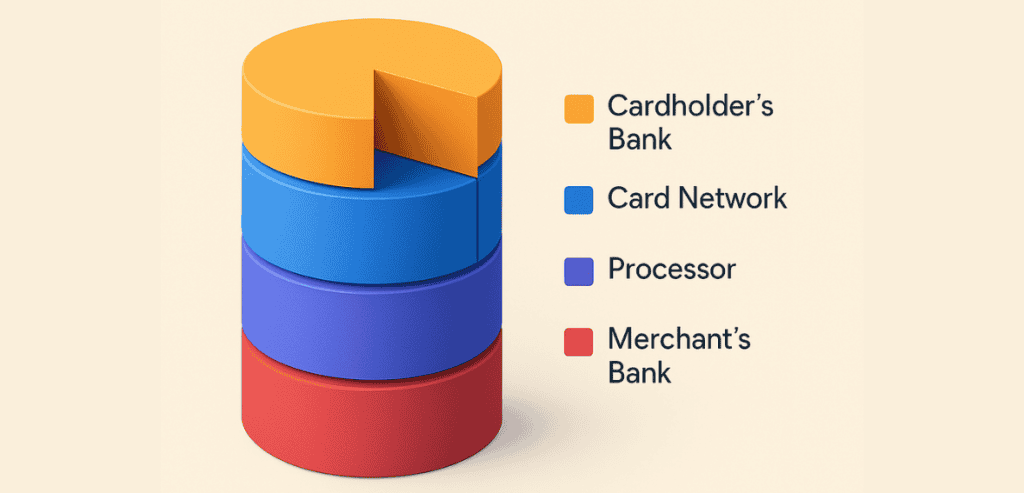

Interchange fees are charges established by card networks (Visa, Mastercard, Discover, and American Express) that are paid to the issuing banks for a customer when they purchase with their credit or debit card. Interchange compensates the issuing bank for assuming the risk of providing credit to cardholders and incurring the administrative expense of processing transactions.

These fees aren’t random—they’re carefully set to balance the interests of various parties in the payments ecosystem. Card networks tweak them now and then, usually every two years (April and October), to reflect evolving market conditions, regulatory needs, and industry trends.

Unlike what most merchants think, payment processors do not determine interchange rates. Instead, they transfer these fees to merchants as part of their total processing fees. This is a very important distinction to understand when considering payment processing providers and negotiating terms.

The Mechanics of Payment Processing

To truly appreciate interchange, it’s important to see how a card transaction moves through the payment system. When a customer pays with a card, the transaction takes these important steps:

- Authorization: The merchant’s payment gateway or terminal sends transaction information to the acquiring bank.

- Routing: The acquiring bank sends the transaction through the correct card network (Visa, Mastercard, etc.).

- Issuers Approval: The card network sends the request to the customer’s issuing bank, which checks the customer’s available funds or credit and authorizes or rejects the transaction.

- Settlement: Once authorized, the issuing bank transfers funds to the merchant’s acquiring bank, which credits the merchant’s account, usually within 24-48 hours.

- Fee Assessment: At settlement, the interchange fee is taken out of the transaction amount before payment is made to the merchant.

All this takes place within seconds at the point of sale, but it involves several players, each with services that facilitate the payment processing. Interchange serves as the economic driver that makes this operation run smoothly.

How Interchange Rates are Structured

Interchange is not a one-size-fits-all fee. Rather, it is tiered based on many variables, producing a high matrix of possibilities. The main drivers are:

- Card Type: Credit cards tend to have higher interchange rates than debit cards, due to the higher risk and rewards features of credit products. High-end rewards cards tend to have the highest of all, in some cases coming close to 3% on some types of transactions.

- Transaction Environment : Card-present transactions (swipe, dip, tap with physical card present) usually have lower interchange fees than card-not-present transactions (online, phone, or mail orders) because of reduced risk for fraud. The disparity can be large—often 0.30% to 0.80% more for online than in-store transactions.

- Business Category: Various merchant categories are assigned various interchange classifications. For instance, supermarkets, restaurants, and gas stations frequently qualify for special interchange programs with better rates due to their distinctive operating features and generally narrow profit margins.

- Processing Method: How you capture payment information impacts your rates. EMV chip transactions usually get better rates than magnetic stripe transactions because they’re more secure. Tokenized transactions (such as from digital wallets) can also get lower rates because there’s a lower risk of fraud.

- Settlement Timing: Promptly batching and settling transactions promptly can get you better rates than settlement at a later time. To qualify for standard interchange programs, most card networks require settlement within 24 hours.

The sum of these results in hundreds of potential interchange categories, each having a different rate. For example, a transaction may be classified as “Visa Traditional Rewards Card-Present” or “Mastercard World Elite eCommerce,” each of which charges different fees.

The Component of Interchange Rates

Interchange rates usually have two elements:

- A percentage of the transaction value (e.g., 1.65%)

- A fixed transaction rate (e.g., $0.10)

All of these come together to equal the overall interchange cost. An interchange rate might be written “1.65% + $0.10,” indicating the merchant is to pay 1.65% of the value of the transaction plus a 10-cent flat fee per transaction.

This format has significant implications for various business types. Merchants with high-volume, low-ticket transactions (such as coffee shops) may be more affected by the fixed fee aspect, whereas those with higher-ticket products (such as furniture stores) are affected more by the percentage aspect.

Optimization: Improving Your Interchange Qualification

Though interchange rates are non-negotiable at the individual merchant level, businesses can take steps to qualify for the best available rates:

- Proper Transaction Code: Ensuring your business is correctly categorized under the appropriate MCC can make a big difference in your interchange rates. Getting it wrong can mean paying unnecessarily high fees.

- Enhanced Data Collection: For B2B transactions, offering Level 2 and Level 3 data (advanced transaction data such as tax amounts, customer codes, and item-level data) may make you eligible for reduced interchange rates. These advanced levels of data can lower interchange fees by 0.5% to 1.0% on commercial card transactions.

- Security Compliance: Sustaining PCI DSS compliance and the use of fraud prevention technologies will ensure that you can be qualified for reduced-risk interchange categories. Non-compliance not only presents security threats but usually leads to increased processing fees.

- Processing Optimization: A few simple changes in operation, such as batching transactions daily, employing address verification services (AVS), and asking for security codes, can enhance your interchange qualification. For card-not-present merchants, these methods of verification can be the difference between regular and downgraded interchange rates.

- Technology Investments: Today’s payment terminals that support EMV chip reading, contactless payments, and point-to-point encryption secure improved interchange rates by lowering fraud risk. Although payment technology upgrades involve initial rates, continuous interchange savings subsequently yield a high return on investment.

The interchange savings opportunity isn’t chump change. For a company processing $1 million per year, even a 0.1% cut in ineffective interchange rates equals $1,000 in bottom-line savings. For bigger companies, the potential can be huge—a retailer processing $50 million per year could save $50,000 or more by optimizing interchange strategically.

How Interchange Effects Different Pricing Models

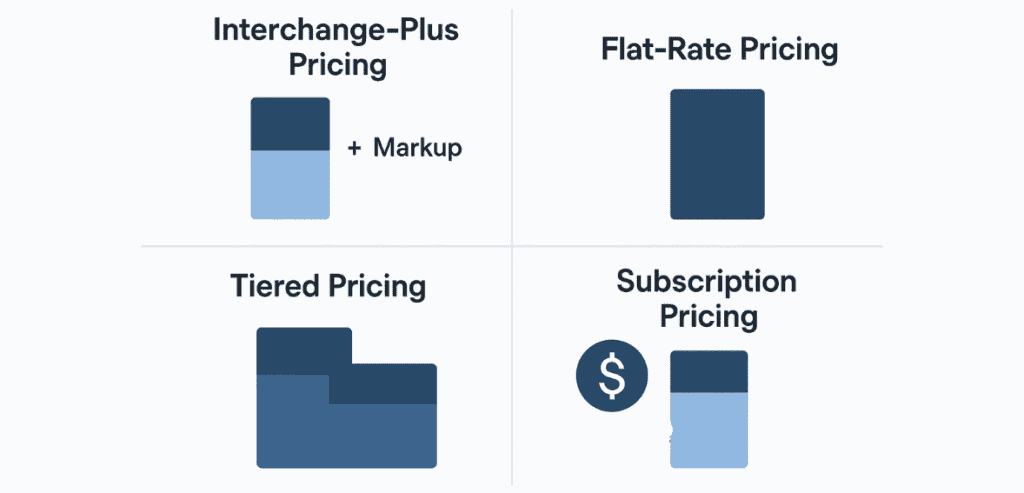

Payment processors generally have multiple pricing models that distinguish between interchange differently:

- Interchange-Plus Pricing: This clear model passes on the true interchange charges plus an outright processor markup (e.g., interchange + 0.30% + $0.10). Merchants know precisely how much of their charges go to interchange and how much goes to processor margin. This model enables companies to immediately realize the benefits of any interchange optimization strategies they adopt.

- Flat-Rate Pricing: Processors such as Square and Stripe provide easy pricing (e.g., 2.9% + $0.30 for every transaction), which combines interchange fees with their markup into one rate. This structure trades transparency for predictability. Though easy for small businesses, easy pricing tends to be costly when transaction volume increases.

- Tiered Pricing: It categorizes interchange categories into plain tiers (mid-qualified, qualified, and non-qualified), with its rate applied to each of them. What seems to be simple is most often hiding real interchange costs as well as the processor margins. Most transactions that qualify for lower rates of interchange get relegated to a higher tier resulting in excessive expenditure for merchants.

- Subscription Pricing: This charges a base monthly fee along with interchange pass-through and a small per-transaction fee that might be valuable for high-fee merchants. Under this setup, processor incentives track merchant incentives because the processor has no more money when interchange rises.

Most mature companies see interchange-plus pricing as presenting the best possible compromise between clarity and cost containment when combined with concerted interchange optimization.

Industry Trends and Regulatory Influences

The interchange environment is dynamic—it changes as a function of market forces, technological development, and regulatory action:

- Regulatory Scrutiny: Across different markets, regulators have put a limit on interchange fees, especially on debit transactions. The Durbin Amendment in the United States, for instance, significantly slashed debit interchange rates for issuers with assets worth more than $10 billion. There are corresponding regulations in the European Union, Australia, and other places.

- Network Competition: Network competition may impact interchange structures because networks compete with each other to win issuer relationships based in part on the interchange revenue they can provide. This competitive pressure occasionally serves against the interests of merchants because networks raise rates to lure issuers.

- Alternative Payment Channels: Growth in alternative payment channels such as ACH transfers, real-time payments, and cryptocurrencies puts competitive pressure on legacy interchange models. With the growing adoption of these alternatives, card networks might be pressured into rethinking their interchange strategies to stay competitive.

- Mobile Wallet Impact: As mobile wallets become more popular, they bring new interchange qualification considerations into play, at times involving tokenized transactions and special rates. The added security of these forms of payment often means reduced fraud, potentially leading to more desirable interchange categories over time.

Forward-looking business owners track these trends to project changes in their payment expenses and adjust their tactics accordingly. Through knowledge of regulatory evolution and technological innovations, companies can position themselves to take advantage of changing interchange frameworks.

Strategic Consideration for Different Business Types

Various business models call for various interchange management approaches:

- Retail: Brick-and-mortar merchants generally enjoy the lower interchange rates of card-present transactions but ought to consider accepting contactless payments and having current terminal technology. Investing in advanced payment terminals with encryption features can further improve interchange qualification.

- E-commerce: Online businesses pay more interchange fees as a result of card-not-present transactions, and fraud protection devices and comprehensive transaction information are, therefore, particularly beneficial to rate optimization. 3D Secure authentication and the storage of complete transaction information can qualify for the lowest available online interchange rates.

- Subscription Businesses: Merchants with recurring billing would do well to adopt account updater services and optimize their descriptor data so that they can increase authorization rates and be eligible for special recurring transaction interchange programs. Specialized interchange categories for recurring transactions with suitably flagged merchant descriptions are provided by some card networks.

- B2B Businesses: B2B businesses stand to save a lot by adopting Level 2 and Level 3 data processing, which can shrink interchange fees by 0.5-1.0% on commercial card transactions. This generally involves integrating payment systems with accounting or ERP systems to automatically capture and transmit transaction information.

- Multi-Channel Merchants: Online-offline businesses must make sure their payment infrastructure correctly segregates the channels so as not to pay higher e-commerce rates for in-store transactions.

Adapting your interchange approach to your business model has the potential to save money in the long run. The most effective businesses optimize their transaction information on an ongoing basis to see optimization opportunities unique to their payment composition.

The Hidden Benefits of Interchange

Although merchants generally see interchange as solely a cost factor, the system offers some indirect advantages:

- Increased Customer Base: Taking cards expands your possible customer base and average transaction value versus cash-only businesses. Research repeatedly demonstrates that customers spend more with cards than with cash—often 12-18% more on average.

- Operational Efficiency: Electronic payments lower the cost of handling cash, reduce errors, and simplify reconciliation. Labor savings from automated payment processing can recoup a large part of interchange costs for most businesses.

- Consumer Protection: Interchange-partly funded chargeback and dispute resolution schemes promote consumer confidence indirectly for merchants by resulting in higher sales volume. While individual chargebacks might prove problematic to merchants, overall they result in consumer confidence generating higher use of cards overall.

- Fraud Protection: Issuing banks have a large investment in fraud detection infrastructure, partly financed with interchange income, that lowers payment system overall fraud loss. The advanced systems identify and block inappropriate fraudulent activity before it reaches merchants.

Considered as a whole, interchange facilitates an effective payment system that adds value to merchants even at its expense. The security, convenience, and dependability of card payments have made them vital to contemporary commerce, the utility of which frequently exceeds the cost.

Making Informed Decisions About Payment Processing

Equipped with a greater knowledge of interchange, traders can make more informed choices regarding their payment processing approach:

- Processor Selection: Select payment providers that are transparent regarding interchange fees and that offer tools to assist in optimizing your qualification. Seek processors who are willing to offer detailed interchange analysis and optimization suggestions tailored to your business.

- Contract Negotiation: Direct negotiations toward processor markup instead of interchange itself, as the latter is not negotiable at the level of the individual merchant. Know that although the processor cannot modify interchange rates, it can determine how your transactions are classified and routed to the networks.

- Technology Investments: Invest in payment technologies that enable qualification for lower interchange rates, like tokenization, 3D Secure, and enhanced fraud filtering. These investments usually recoup their cost through lowered payment expenses and decreased fraud losses.

- Data Analysis: Periodically review your merchant statements to determine which transaction types have interchange costs over what is necessary and resolve the underlying causes. Several processors have reporting capabilities that detail your interchange qualification and point out improvement opportunities.

- Diversification of Payment Mix: Investigate non-traditional payment methods that can have a lower cost for processing than a traditional card transaction for specific transaction types. Payments by ACH, for example, usually incur much less in costs than by card for automatic billing situations.

Conclusion

Interchange rates serve as a critical sophisticated element that dominates the modern payment process. Awareness of interchange charges enables companies to re-engineer payment systems thus cutting costs despite these charges posing a significant financial strain on retailers.

Genius businesspeople see interchange as a strategic business asset instead of an immutable mystery. Businesses become successful in the interchange environment through the use of appropriate technology platforms and by optimizing transaction processing and payment partner selection.

The evolving payments industry requires a greater understanding of interchange developments due to its rule changes and fresh technological advancements. Strategic planning for interchange causes companies to derive a competitive advantage from lower payment costs as well as improved operational effectiveness and enhanced customer satisfaction.

Interchange understanding is more than just paying fees since it involves total awareness of electronic payments system economics and business positioning within the structure of the system. By having enough understanding and appropriate interchange handling merchants can convert these expenses into a controlled business element.